Gibali said laws drafted by MPs Hala Abul Saad and Emad Saad Hammouda on tax evasion penalties and the organisation of the new housing communities were referred to. For example Google has used highly contrived and artificial distinctions to avoid paying billions of pounds in corporate tax owed by its.

10000 Quiz Questions And Answers Quiz Questions And Answers Quiz Knowledge Quiz

Tax evasion investigators raid Googles Paris headquarters.

Reasons of tax evasion in egypt. Sales tax gradually became widespread over Europe. The tax rate under normal circumstances was 1 and sometimes would climb as high as 3 in situations such as war. But now economic nexus laws have created both new collection obligations and new.

Corruption is a cancer eating. 5 Reasons Why to Have an Offshore Bank Account Energy independent Bolivia may still rely on Russias help Cyprus amends its IP regime a Brexit would surely have some kind of impact on the Crown Dependencies Business in Hong Kong Just Became Easier Economic Substance in Zero Tax UAE. Form 945 must be filed with the IRS by January 31 of the year succeeding the year of payments.

A lot but not all of what gets called tax avoidance could be criminalized or overturned if there were a court challenge but much of it remains secret. Scott Peterson calls this Americas sales tax gap. According to the traditional definitions tax evasion is illegal a crime but tax avoidance uses legal loopholes to reduce or avoid paying taxes.

More than 3000 years ago the inhabitants of ancient Egypt and Greece used to pay tax consumption taxes and custom duties. Credit Suisse is the next big bank blamed for large tax-evasion scheme. The purpose of this doctrine is to prevent corporate taxpayers from structuring a transaction solely for tax avoidance reasons.

He says theres not a lot of criminal behavior in sales tax compliance. FATCA the Foreign Account Tax Compliance Act was enacted in 2010 to prevent and detect offshore tax evasion by US persons. The doctrine is often combined with the step transaction doctrine which can treat a corporate taxpayers series of transactions as one single integrated event thus changing the tax treatment.

In Europe sales tax appeared firstly during the reign of Julius Caesar around 49 BC-44 BC when the government of Rome enforced a payment of 1 percent sales tax. On the other hand. The first income tax is generally attributed to Egypt.

The Convention shall not be construed to prevent a Contracting State from applying the provisions of its domestic law on the prevention of tax evasion or tax avoidance. Posted on October 24 2021. Increasingly experts argue that the distinction is blurry.

The marsh harriers were pretty impressive too - but too far away for anything like a good phot0graph. In 1918 A New Income Tax bill was passed and which was further. Part of my reason for being in Chile is to deliver this message.

When we redefine corruption well change its geography and will recognise that within our own communities as well as that which takes place elsewhere. For the most part sales tax evasion consists of small vendors with a lot of cash transactions using tax zappers to erase some sales. He also indicated that the new general finance law which was discussed and approved by the Senate in its first legislative session was referred to the House to be discussed.

The economic substance doctrine allows the IRS to review transactions. October 24 2021 at 629 pm. Richard Murphy on tax accounting and political economy.

Tomb paintings in Egypt dating back around 2000 BC portray tax collectors and sales taxes on commodities such as cooking oil can be traced to that time Fox 2002. This remark was linked to the content of article 281a of the Germany-Spain tax treaty. These modest taxes were levied against land homes and other.

Cattle walking the river bank against a very East Anglian sky at the Wetlands and Wildlife Trust Welney reserve this afternoon. In the early days of the Roman Republic public taxes consisted of modest assessments on owned wealth and property. Hence the enforcement of a domestic GAAR does not violate the tax treaty and thus MAP access must be denied.

Gibali said laws drafted by MPs Hala Abul Saad and Emad Saad Hammouda on tax evasion penalties and the organization of the new housing communities were referred to concerned committees to be discussed. In order to meet the losses sustained by the government on account of military mutiny of 1857. Income tax was first introduced in India in 1860 by James Wilson who become Indians First Finance Member.

Google has been accused by a number of countries of avoiding paying tens of billions of dollars of tax through a convoluted scheme of inter-company licensing agreements and transfers to tax havens. In addition all tax evasion and I think all tax avoidance is corrupt the latter precisely because it seeks to avoid the obligations of the law. The payor also must file Form 945 Annual Return of Withheld Federal Income Tax to report any backup withholding.

Uk Motorists Look Away Now Venezuela Tops The Ten Cheapest Countries In The World For Petrol At 8p A Litre Infographic Petrol Price World

Panama Logo 512x512 Url Dream League Soccer Kits And Logos Soccer Kits World Cup Kits National Football Teams

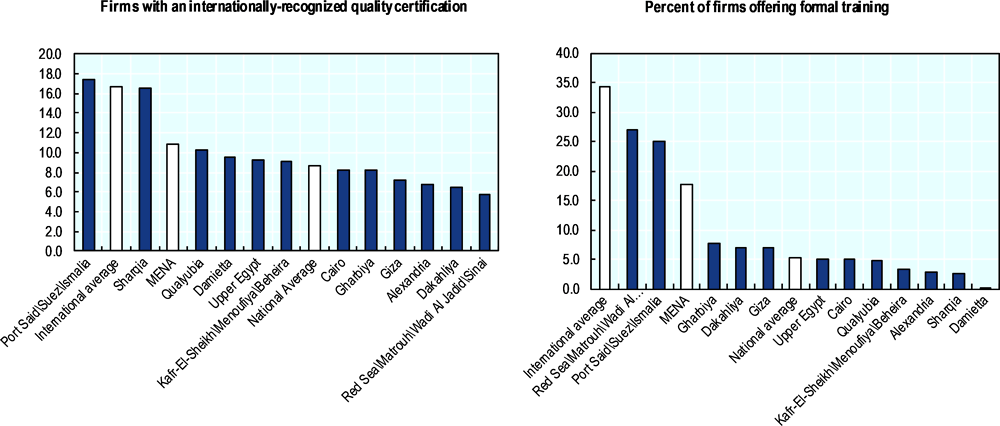

Arab Republic Of Egypt In Imf Staff Country Reports Volume 2018 Issue 015 2018

Arab Republic Of Egypt In Imf Staff Country Reports Volume 2018 Issue 015 2018

Arab Republic Of Egypt In Imf Staff Country Reports Volume 2018 Issue 015 2018

Egypt S New Unified Tax Procedures Law Riad Riad Com

Arab Republic Of Egypt In Imf Staff Country Reports Volume 2018 Issue 015 2018

Arab Republic Of Egypt In Imf Staff Country Reports Volume 2018 Issue 015 2018

الصفحة الرئيسية Google Adsense Adsense Website Monetization Earn Money

Cairo S Billboards Celebrate 20 Years Of Amr Diab X Pepsi An Ooh Campaign In 2021 20 Years Cairo Pepsi

The Trial By Fire St Francis Offers To Walk Through Fire To Convert The Sultan Of Egypt Giotto Wikipaintings Org Renaissance Art Giotto Painting

Zone Based Policies Oecd Investment Policy Reviews Egypt 2020 Oecd Ilibrary

Tories Support The Wealth Creators Whilst Vince Devises Plan To Tax Supportive How To Plan The Creator

Bitter Options For Egypt As Tax Evasion Persists Hassan Abdel Zaher Aw

Banks Continue To Invest Time And Money In Blockchain Projects And Trust Still Remains So Important Los Angeles Attractions Real Estate Usa Travel

Swissleaks The Map Of The Globalized Tax Evasion Swiss Bank Data Visualization Design Map

Arab Republic Of Egypt In Imf Staff Country Reports Volume 2018 Issue 015 2018

ConversionConversion EmoticonEmoticon